gilti high tax exception statement

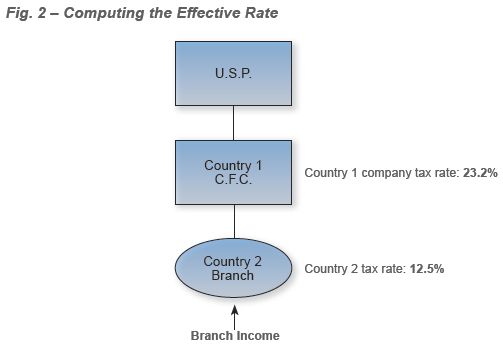

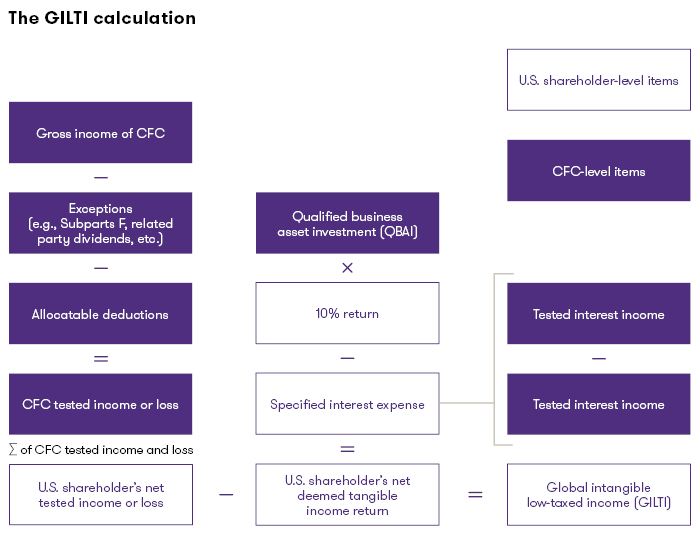

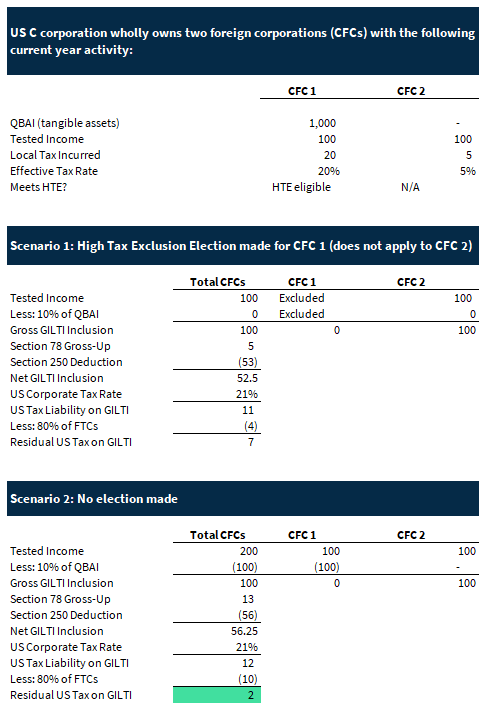

Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the. Since the introduction of the Global Intangible Low-Taxed Inclusion GILTI in the 2017 Tax.

Final Gilti Hte Regs Provide Flexibility Grant Thornton

Applies to registered small business that do not have taxable and nontaxable gross receipts exceeding 100000 from within and out of the City of Los Angeles worldwide.

. 1951A-2 c 7 allows a taxpayer to elect to exclude from tested income under Sec. Consumer Use Tax Section MIC37. Annual Secured Property Tax Bill - The Annual Secured Property Tax Bill is mailed on or before November 1 of each year.

Final GILTI High-Tax Exception The high-tax exception in Reg. However taxpayers may retroactively apply the GILTI high-tax exclusion to taxable years of foreign corporations that began after Dec. 954 b 4 a so-called.

Consistent with the applicability date in the 2019 proposed regulations the final regulations provide that the GILTI high-tax exclusion applies to taxable years of foreign corporations. See Revenue and Taxation Code section 207 This. The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum US.

GILTI High Tax Exception Considerations. Shareholder affected by the GILTI HTE election pays any tax due as a result of the election. The Religious Exemption may be claimed on property owned by a religious organization and used exclusively for religious purposes.

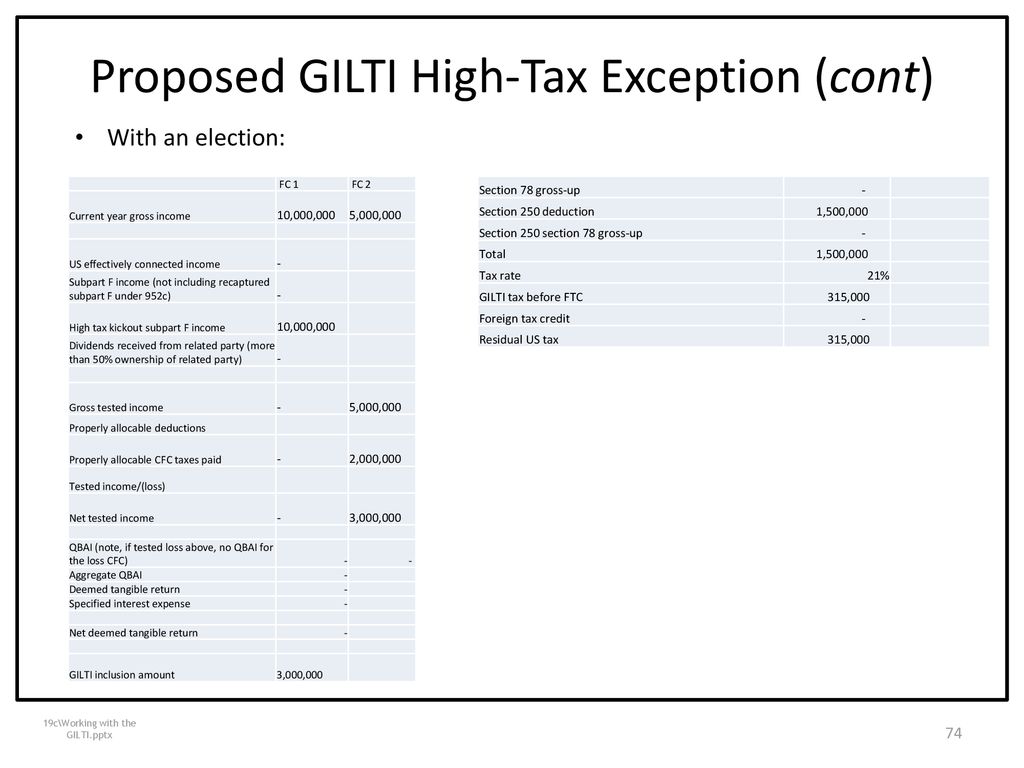

Tax liability would be increased and 3 each US. 31 2017 and before July 23 2020 and to. The GILTI HTE can provide a generous benefit because taxpayers would be able to remove GILTI CFCs from their calculation of GILTI and therefore lower their GILTI inclusion.

The Treasury Department and IRS issued proposed regulations in 2019 which provided a GILTI high-tax exception as follows. Out effective tax rates or creating the HTE Election. Some offices are not equipped.

By making the GILTI high-taxed election active income of a CFC taxed at a minimum effective rate is excluded from the scope of tested income and in turn the income. Election for tax years in which the US. The annual bill has two payment stubs.

The high-tax exception was elective by a CFCs. The GILTI hightax exception together with the subpart F high- tax exception have the potential to broadly - expand a CFCs exempt income where it operates in sufficiently high. California Department of Tax and Fee Administration.

The proposed regulations generally conform the high-tax exception under the subpart f regime with the high-tax exclusion under the gilti regime thus departing from the manner in which the.

Final Gilti Hte Regs Provide Flexibility Grant Thornton

Insight Fundamentals Of Tax Reform Gilti

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

Insight Fundamentals Of Tax Reform Gilti

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Gilti Tax For Owners Of Foreign Companies Expat Tax Professionals

Demystifying Irc Section 965 Math The Cpa Journal

954 C 6 Considerations For 2021 Global Tax Management

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

Tax Proposals Under The Build Back Better Act Version 2 0

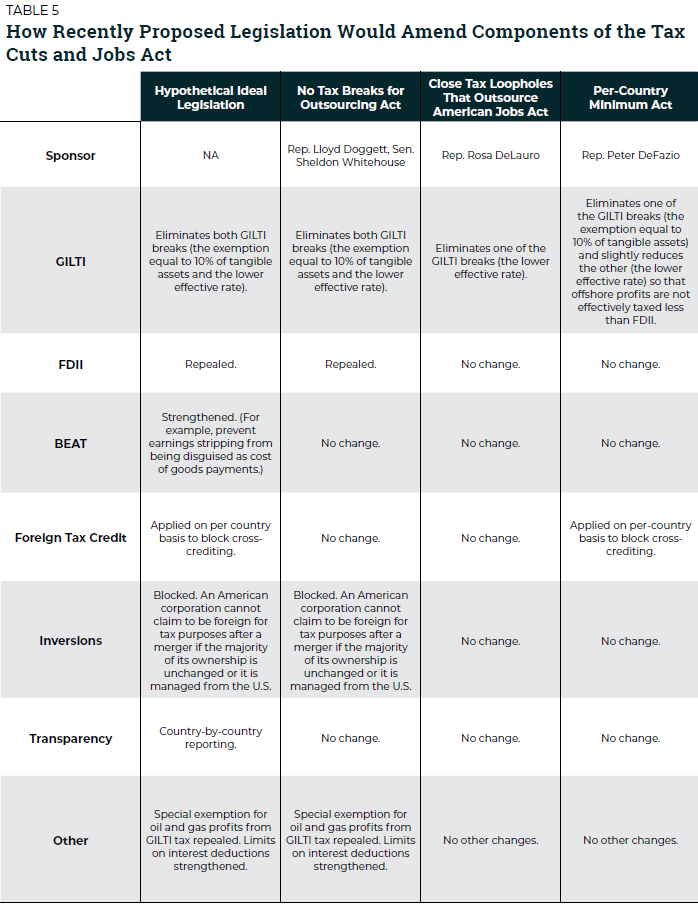

The Challenges Of A Semi Territorial Tax System And Some Potential Resolutions International Tax Report

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

A Streamlined Procedure Does Not Clear A Gilti Conscience Baker Tilly Canada Chartered Professional Accountants

Understanding And Fixing The New International Corporate Tax System Itep

How Foreign Subsidiary Owners Can Plan For Gilti Hte

Final Regulations Clarify Potential Benefits Of The Gilti High Tax Exclusion Our Insights Plante Moran